Cities Addressing Fees & Fines Equitably (CAFFE)

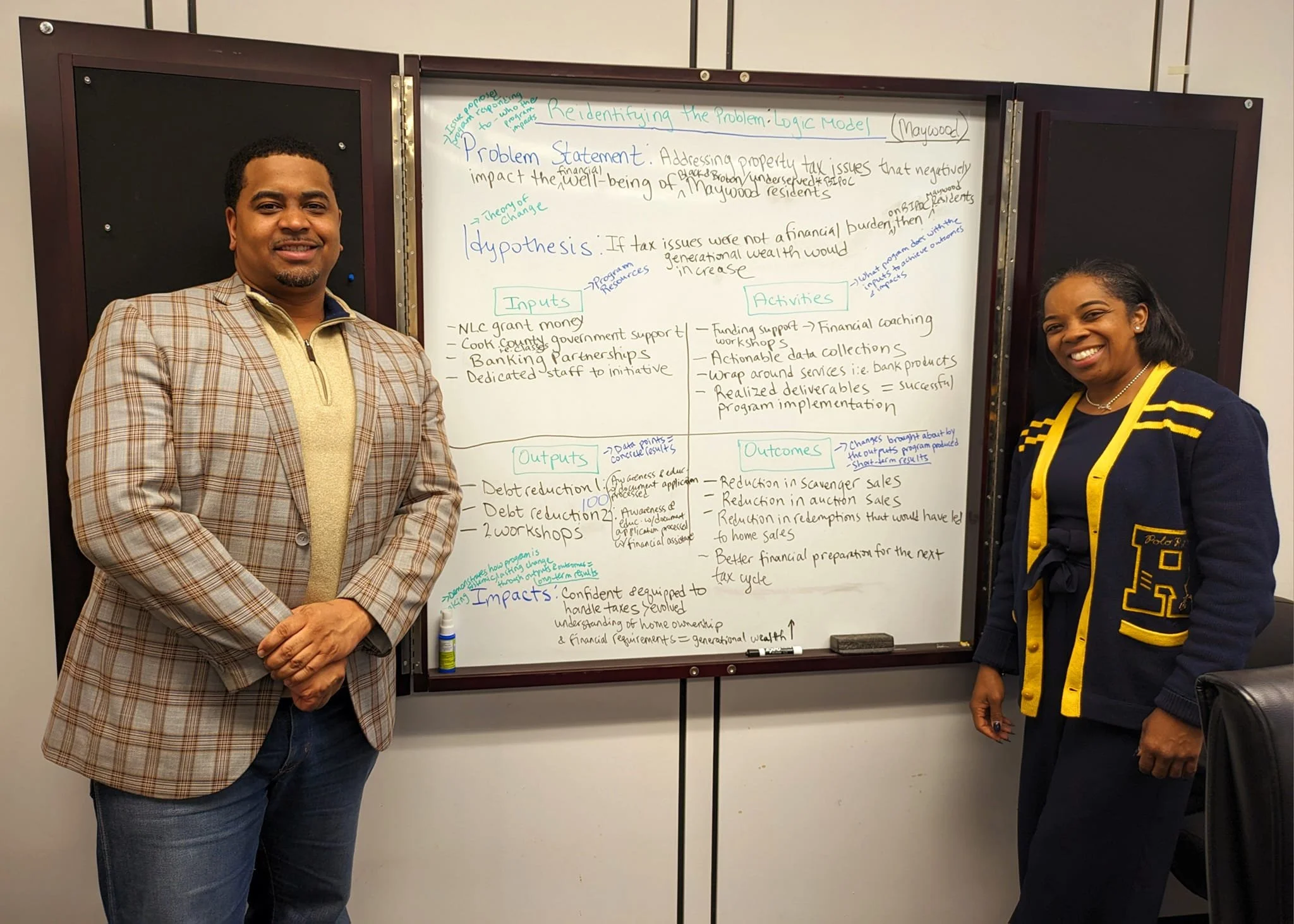

Village of Maywood Partners with the National League of Cities to Reduce Harmful Effects of Municipal Fines & Fees Working to Address High Property Taxes

Participating cities will engage in peer learning opportunities, virtual and in person. In addition, participants will receive tailored technical assistance from NLC staff and national content experts to help advance the city's efforts in expanding economic opportunities for low-to-moderate-income families through policy reforms and access to financial services.

Mayor Nathaniel George Booker also cited, “many historically Black communities have been destroyed due to high property taxes once the family home has been passed down to the next generation. Annual property taxes should not be as much as paying rent. When an elder dies and leaves the home, they paid off to the family, too many times the family cannot afford the property taxes”. Multiple cities have implemented strategies to address these negative impacts, including reforming fines and fee structures and enacting ability-to-pay policies as an alternative solution

Driven by curiosity and built on purpose, this is where bold thinkThe initial planning phase of the work will begin followed by project implementation. This will cover support for data collection and analysis from external partners, stakeholder engagement with community organizations, residents, and other partners. In Moving Maywood Forward Together, the village will implement innovative financial empowerment approaches to help our residents, businesses, and regional competitiveness. “Local fines and fees create a disproportionate amount of financial shocks to underserved communities, especially communities of color. Finding sustainable and equitable solutions to them will be key as communities continue to navigate the impact of the pandemic, said Sarah Willis-Ertur, Head of Financial Health, Global Philanthropy at JPMorgan Chase.

Interest Rates Slashed from 18% to 9% for Homeowners who are late paying property tax bills

“Focusing on property taxes being the highest fee for residents, we have been collaborating with NLC, Cook County’s teams within the offices of Clerk Karen Yarbrough, Treasurer Maria Pappas, and Assessor Fritz Kaegi along with Illinois State Legislators to focus on property taxes”, said Maywood Village President, Mayor Nathaniel George Booker. “Local fines and fees create a disproportionate amount of financial shocks to underserved communities, especially current or former predominantly Black communities. Finding sustainable and equitable solutions to lessen the financial burden of residents who pay into the government everyone benefits from will be key as Black and Brown along with underserved and disadvantaged communities continue to navigate government fees and fines.

National League of Cities welcomed the Village of Maywood to Dallas for us to discuss our work on property taxes under the Cities Addressing Fees and Fines Equitably (CAFFE) initiative.

Discussing Targeted Universalism while acknowledging DEI, we were able to present how over the past 20 years and beyond Black homeowners/businessness owners and Black generational wealth was stolen for no other reason but property taxes. We are still predominantly Black, but now a Healthy mixed Black and Brown community. Right wrongs of the past solutions have been identified and are an intentional genuine focus. Stay tuned for more in our journey of righting wrongs while celebrating diversity at the same time.

Village of Maywood joins City Inclusive Entrepreneurship (CIE) with National League of Cities

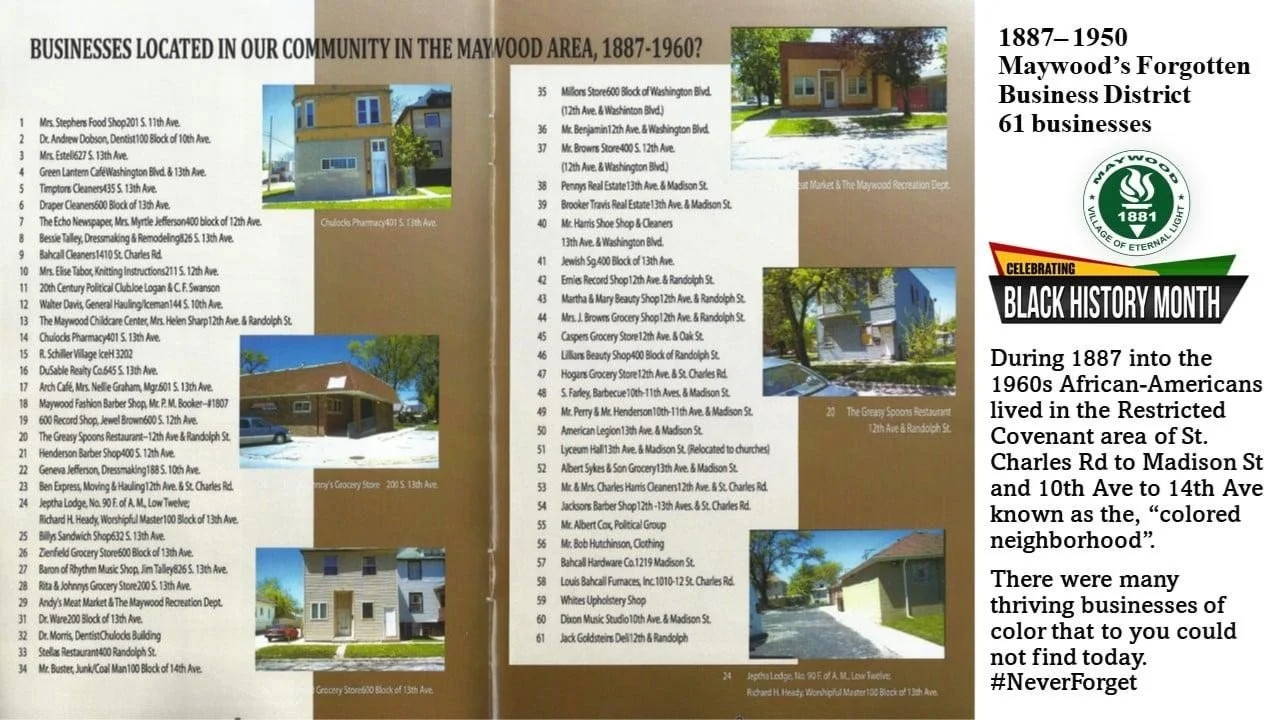

“Maywood is a historic culturally rich community. By the 1960’s, our Village of Eternal Light had a Black Business District of 65 Black-Owned Businesses,” said Nathaniel George Booker, Village President of Maywood, . “Today, none of those businesses are open and the district is now residential with nothing to show it ever existed. As we focus on Elements of a Healthy Maywood and continue in Moving Maywood Forward Together, I am excited about this partnership. The CIE will be a part of Elements of a Healthy Maywood; Social & Cultural Cohesion and Economic Opportunities focus areas.”

The CIE program, an initiative of the National League of Cities, helps cities adopt policies, programs and practices to give underrepresented entrepreneurs more opportunities for economic advancement. Participants select an area of focus for their programs to support economic growth in their communities, including working with startups, creating microlending platforms and improving access to procurement opportunities for MWBEs.

Maywood Featured at NLC for Housing Stability

Thankyou, Chanell Hasty, MA of National League of Cities for selecting the Village of Maywood as a feature for our work on addressing our Property Tax Rate through the Cities Addressing Fees and Fines Equitably Cohort.

Thank you Senate Majority Leader Kimberly Lightford, Speaker Emanuel "Chris" Welch, Cook County Assessor's Fritz Kaegi, Cook County Land Bank Authority, Cook County Clerk Karen A. Yarbrough, Cook County Treasurer's Office Maria Pappas, Liberty Bank, Chase Bank and so many other partners for collaborating in Moving Maywood Forward Together.

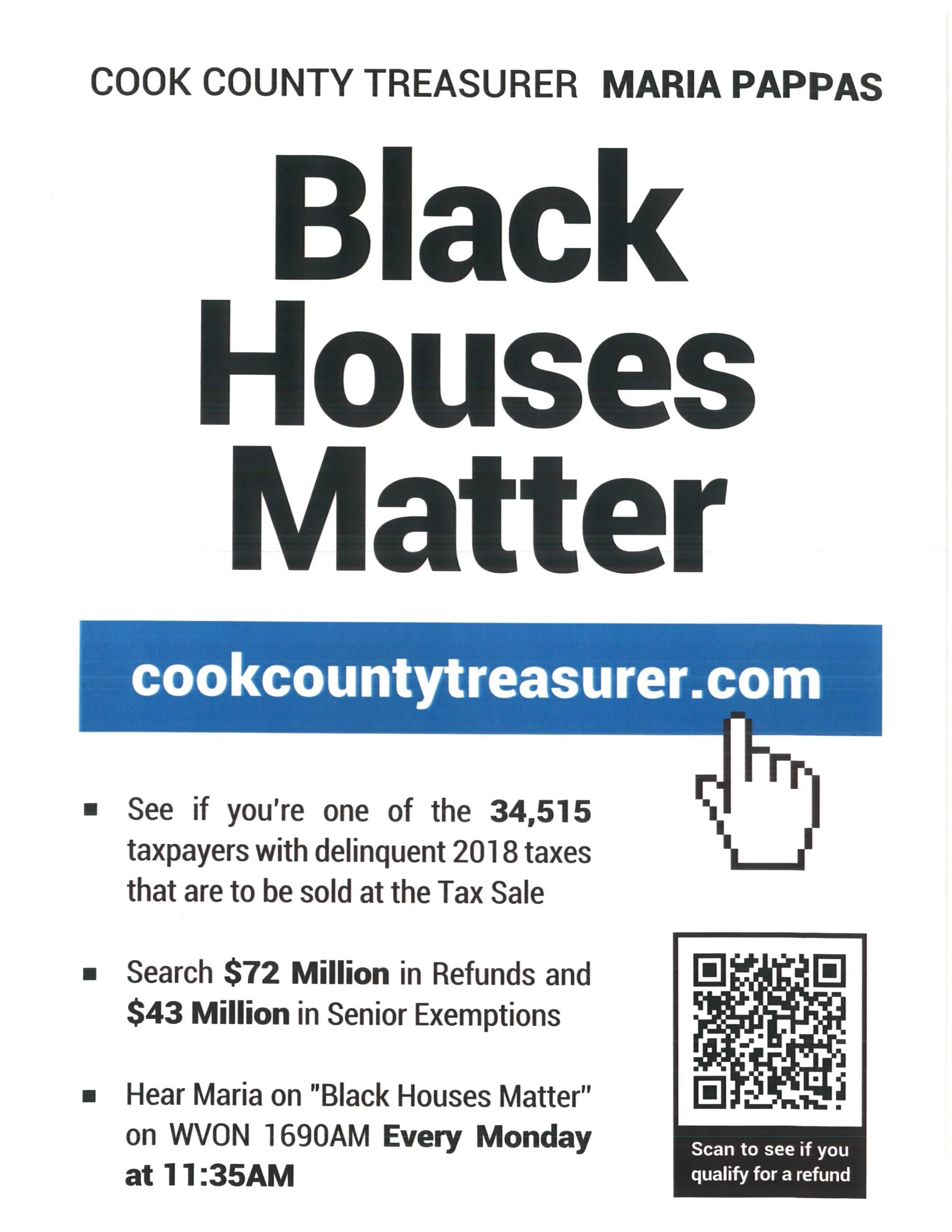

Cook County Treasurer Maria Pappas focuses on Black Homes and Property Tax Errors

Thoughtfully crafted to elevate what matters most.For decades, tax liens — working in tandem with unfair property assessments — have disproportionately caused Black Americans to lose their homes in cities across the United States. In Cook County, a majority of tax evictions happen in Black neighborhoods such as Woodlawn, where Miles lives, according to a report by Housing Action Illinois. And during the twice-a-year tax sales, 75% of tax debt offered for sale are for homes in Black and Latino neighborhoods.

The goal is to prevent residents from losing their home due to unpaid property taxes and connect them with their property tax refunds and exemptions. "This is a very depressing time in human history," Pappas said. "We have wars, we have inflation, we can't get baby formula, people can't pay their taxes. So, you know what? Maria Pappas is going to make people happy, and that's what we do."

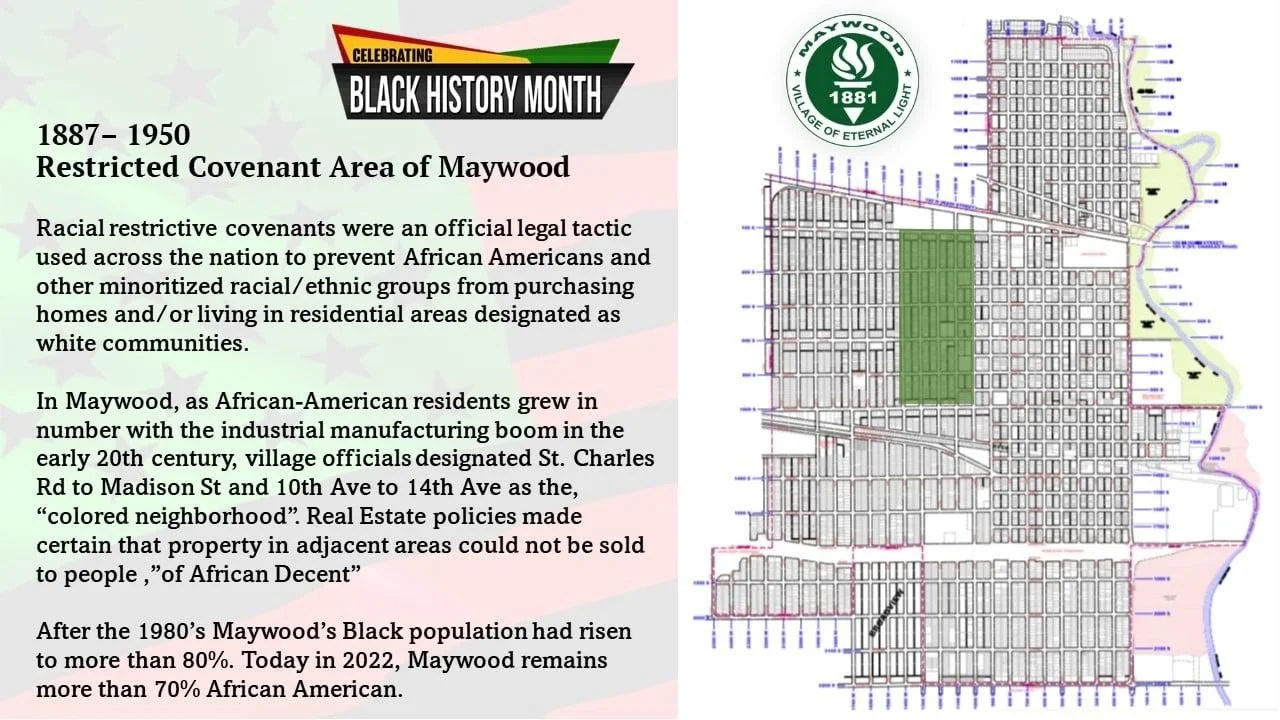

The Covenant Project

The Village of Maywood lost Black generational wealth of more than 1,000 properties between 2012 and 2017. The Black population has dropped by more than 20% since 2000 because of theft of homes through property tax penalties and property scavenger sales. The Covenant Project works to atone for the lack of property tax resources and protections that exist today.

To increase Black-owned businesses, several strategies need to be employed, including strengthening community engagement, leveraging non-traditional funding, showcasing strong value propositions, building diverse teams, and fostering investor relationships. Additionally, addressing systemic barriers within the venture capital industry and advocating for policy changes can create a more equitable playing field.

Mapping entrepreneurial resources for Black-owned businesses involves identifying and organizing available support systems, including financial assistance, mentorship programs, networking opportunities, and business development resources, to facilitate their growth and success. This process often includes creating directories, maps, and platforms that connect Black entrepreneurs with these resources.

✔Identify Key Resource Categories: Financial Resources, Mentorship and Networking, Business Development Support, Marketplace and Directories, Advocacy and Policy Support, Digital Resources

✔Utilize Existing Mapping Efforts: Black-owned Business Directories, Community Mapping Initiatives, Local Government Initiatives

✔Develop New Mapping Tools and Platforms: Interactive Maps, Data-Driven Dashboards, Resource Aggregators

✔Promote and Disseminate the Mapped Resources: Social Media Campaigns, Community Events, Partnerships

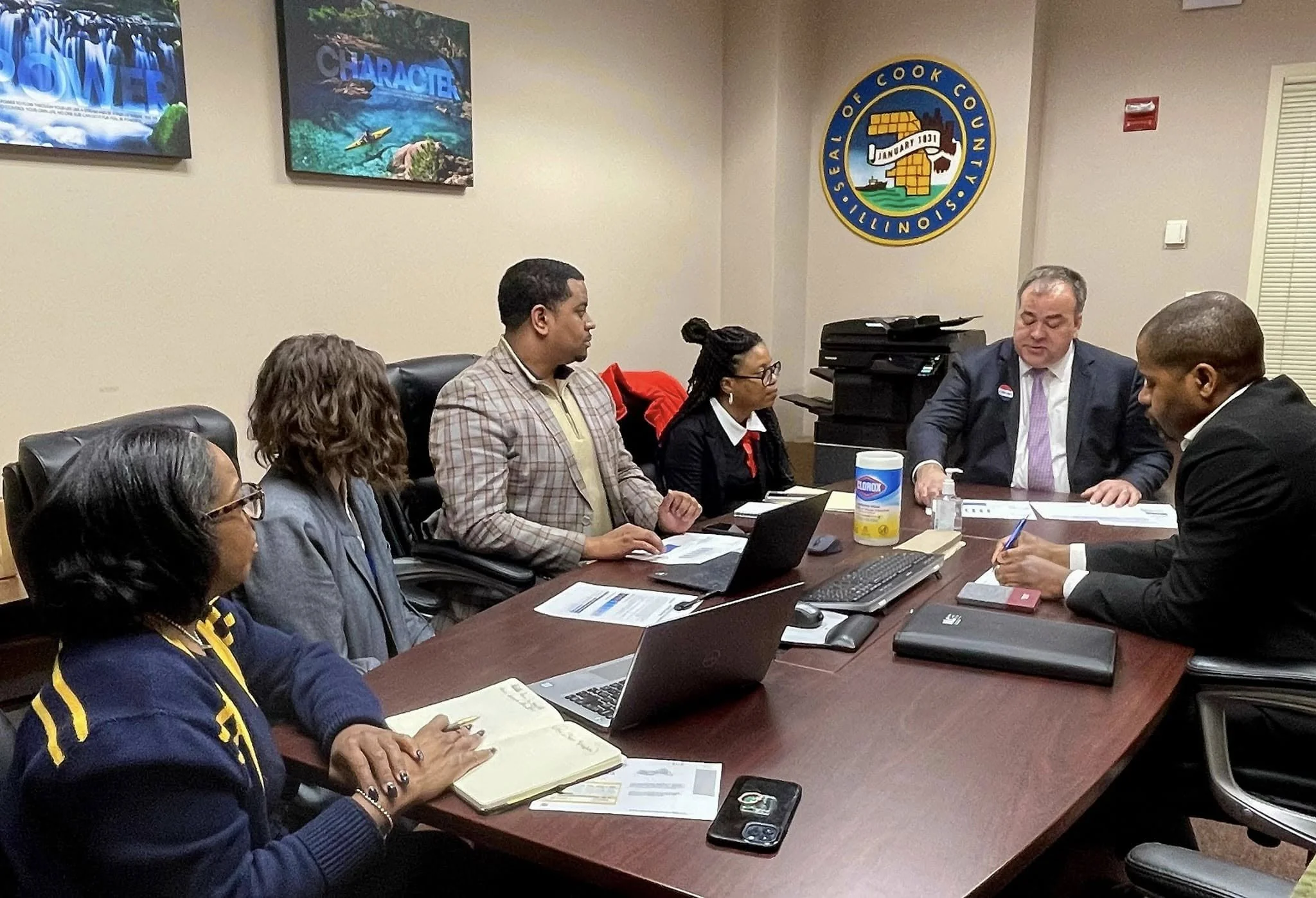

Black Mayors address State & County Officials

“As President of the Illinois Black Caucus of Local Elected Officials (IBC-LEO), it was an honor to host in partnership with Commissioner Tara Stamps Southland and West Suburban Black Mayors, the Chicago Black Alderman Caucus, Cook County, and Illinois Legislative Black Caucus, as we discussed Property Taxes.” - Mayor Nathaniel George Booker

We have launched a Property Tax Taskforce across all taxing bodies to address policy and practice changes that impact the taxes within the State of Illinois and Cook County. As we are looking to address policy and legislation leading to true solutions, we will be hosting meetings here in the Village of Maywood to address things like Certificates of Error, Exemptions, and Appeals with the Assessors Office along with pre-appeal processing with the Board of Review.

As Mayor, I am proud to say, the village has not raised our tax lexy during each year of my administration. I am calling on all governing bodies within our taxing map to HOLD THE TAX by not increasing your levy this coming season. More to come…

Thank you Cook County Land Bank Authority, Cook County Treasurer's Office, Cook County Clerk's Office, Cook County Board of Review Commissioners Larry Rogers, Jr., Samantha Steele, and George A. Cardenas, Cook County Assessor's Office Assessor Fritz Kaegi and all elected officials for coming to begin the journey of Property Tax transformation.

HB1377 Passed

Amends the Property Tax Code. Creates a residential new construction homestead exemption. Provides that the county board of a county with more than 3,000,000 inhabitants, or any other county that elects to be a qualified county, may designate one or more geographic areas within the county as eligible areas. Sets forth certain requirements for an area to be designated as an eligible area. Provides that newly constructed homestead property that is located in an eligible area is entitled to a residential new construction homestead exemption equal to 50% of the assessed value of the property in the current taxable year. Provides that the exemption shall continue for a period of 10 consecutive taxable years or until the property is sold, transferred, or conveyed to a subsequent owner (other than a subsequent owner that meets certain specified conditions), whichever is earlier. Effective immediately.

Maywood Launches Launch Pad & Beyond the Ribbon

Welcome to our new Business Development Support Program Initiatives, LaunchPad Connect – Your Guided Journey to Opening Day and Beyond the Ribbon: 6-Month Post-Opening Success Program. As we build on the Elements of Healthy Maywood focusing on Economic Opportunities, we have partnered with Joseph Business School with Joseph Business Services.

LaunchPad Connect is a comprehensive business development support program designed to assist the Village of Maywood in fostering successful business launches and sustainable growth within the village and target the concept to opening stage of business development. Congratulations to the pilot businesses Rubys Soulfood (715 S 5th Ave), Design Wellness Spa Uncle Dave's Fish Joint, Lickle A Jamaica (620 S 5th Ave)

Beyond the Ribbon is a structured six-month program designed to help newly opened businesses establish strong operational foundations, optimize their market presence, and achieve sustainable growth. The program combines hands-on advisory support with practical tools and metrics-driven evaluation. Congratulations to the pilot businesses Legend’s Legends Grill & Music Venue (9 N 5th Ave), New Era Restaurant (15 N 5th Ave), Board and Bark (608 S 5th Ave), Xtreme Nutrition HB (852 S 17th Ave).

Thank you Small Business Development Center SBDC Illinois, SBDC Illinois International Trade Center, Illinois APEX Accelerator, Carver Cloud, and Carver Innovation for collaborating to build small business community local retail sustainability programs that can we used as a template for the nation. As we focus in Healthy Maywood West Cook – Building Healthy Communities, we look forward to continuing Moving Maywood Forward Together.

Reimagining Maywood Focuses on Business & Housing Growth With 3by30

The Village of Maywood is so excited to be partnering with, Wintrust Bank, Proviso Community Bank, Associated Bank, Fifth Third Bank, Austin African American Business Network Association - AAABNA, Joseph Business School, YWCA Metropolitan Chicago and more to focusing on Reimagining Quality & Equitable Housing along with Economic Stability.

The Covenant Project will focus on working with 3by30:

Generational Wealth

Pride

Stability

Tax Benefits

Improve Your Credit

Extra Cash

Build Personal Wealth

Improve Your Community

Freedom and Control

An Investment In the Future

Maywood Partners with MyVillage to Build Development Ecosystem

The MyVillage Project is a community-focused nonprofit initiative that supports and amplifies the work of Black-led grassroots organizations and nonprofits to improve educational outcomes, family engagement, and community opportunity for students — especially in Black and underserved communities.

MyVillage will be working with the Village of Maywood to build an ecosystem where developers, real estate agents, interested home buyers, tradesman, and more can come together to rebuild and tax reactivate blighted properties.

Strengthening educational outcomes and closing opportunity gaps by empowering community-rooted leadership rather than importing solutions from outside.

Building autonomous systems where communities generate tools, content, and strategies that reflect their own values and goals.

Cook County Assessor Addresses Missed Property Tax Exemptions in Maywood

The job of the Cook County Assessor’s Office is to calculate a fair market value for your property. In calculating fair market value for residential properties, we consider what the fair cash value would be for your property if it had sold recently in its reassessment year. For residential properties, your property’s assessed value equals 10% of its fair market value, per Cook County ordinance.

The Assessor's estimate of your home's fair market value is based on two things: your home's characteristics, and patterns between how other homes' characteristics affected their sale values. We use recent sales of homes similar to yours, in and around your neighborhood, to estimate your home’s value. Homes more similar to yours, or closer geographically to yours, make more of a difference in our calculation than other homes.